Version 2 - Last Updated: 09 Jun 2025

Advanced Learner Loan factsheets

Quick reference guides you may find useful when administrating Advanced Learner Loans.

General

Advanced Learner Loans – a guide for academic staff

Advanced Learner Loans are available to learners aged 19 or above. They can help with the cost of fees for approved further education courses at level 3, 4, 5 or 6.

The Department for Education (DfE) allocates a loan facility to approved learning providers each year. This determines how many learners you can have funded with the loan. DfE also sets out your responsibilities of learning providers in their Funding and Performance Rules each year.

We then pay out Advanced Learner Loans to you on behalf of individual learners. We pay these in instalments each month.

To receive the payments for learners, you must confirm their ongoing attendance. It is very important that you do this accurately and on time.

You must follow our set of service standards. These are underpinned by DfE's Funding and Performance Rules. You must tell us as soon as possible if learners

- suspend their studies

- resume their studies

- withdraw from courses

If any information you give us is late or wrong, this can mean that:

- you receive an incorrect fee payment amount (and we may need to claw back funding)

- learners owe an incorrect fee amount (this can mean they're liable for more loan than they should be, and are also charged additional interest)

- you risk breaching your obligation to adhere to the service standards

Your academic staff must give Advanced Learner Loans administrators the information they need to manage loans in line with our service standards. This will include register marks and any changes to a learner’s enrolment status.

We track your performance on attendance confirmations and notifications of suspensions and withdrawals.

If you consistently fail to meet the service standards, this can limit or even jeopardise the amount of Advanced Learner Loan funding available to you.

Practitioner resources

For more information about Advanced Learner Loans and some useful tools and materials to share with learners and staff, visit the supporting materials on the SFE practitioner website.

If you want to create your own promotional materials, you can view and download the Advanced Learner Loan logo and style guidelines here.

Download the Advanced Learner Loan style guidelines

Download the Advanced Learner Loan logo (jpg)

Download the Advanced Learner Loan logo (png)

2023/24 residency policy changes

There are 4 policy changes for residency for 2023/24

- The date of residency requirements has been amended from the 1st day of the 1st academic year to the 1st day of the course for certain categories

- The requirement to be lawfully resident on the 1st day of the course for certain categories qualifying via an ‘event’ has been removed

- Residency address history checks have been capped at a maximum of 3 years for certain categories

- The standard residency requirements that apply to learners applying via an ‘event’ have been reinstated

Amending the date of residency requirements from the 1st day of the 1st academic year to the 1st day of the course for certain categories

Prior to 2023/24 learners within the protected categories, as well as DVLR and Bereaved Partner learners needed to be resident in their domicile on the first day of the first academic year of their course.

From AY 2023/24 onwards, learners in the following categories will instead need to be resident in their domicile on the first day of the first term of their course:

- Calais leave

- Section 67

- Stateless Persons

- Humanitarian protection

- Refugees

- ARAP/ACRS

- Ukraine Schemes

- Domestic Violence Leave to Remain

- Bereaved Partners

This change will also apply to any qualifying family member who is eligible for support via their relationship with an individual within these residency categories.

Removal of the requirement to be lawfully resident on the 1st day of the course for certain categories qualifying via an ‘event’

Prior to 2023/24, when a person is granted leave to remain by the Home Office via DVLR/Bereaved Partners/any of the existing eligible “protection-based categories”, they can use this status as an event and qualify for support part-way through their course.

However, to do so, learners still need to be ordinarily resident in England on the 1st day of the 1st academic year/day of the course. Some people may find this more difficult than others because they may have been in the UK unlawfully before being granted their DVLR/Bereaved Partner/protection-based leave.

These categories do not carry the standard three-year UK ordinary residence requirement in recognition of the fact that they may not have been in the UK lawfully at the relevant time.

This includes people in the protection-based categories who may have been in the UK as an asylum seeker before being granted a form of temporary status (such as a refugee).

Asylum seekers are not in the UK lawfully, and therefore DfE may be inadvertently preventing such persons from benefiting from the events provisions in the regulations.

The categories are

- Calais leave

- Section 67

- Stateless Persons

- Humanitarian protection

- DVILR

- Refugees

- Bereaved Partner

- ARAP/ACRS

- Ukraine schemes

From 2023/24 the regulations will be changed for new applicants to remove the need to be lawfully resident in England for DVLR/Bereaved Partners/certain protection-based categories on the 1st day of the course where they qualify for support via an event.

Instead, learners in these categories will only need to be resident in England on the relevant date. This means learners who were resident in England, and subsequently gain a protected status after the 1st day of their course via an event can gain access to student support.

Learners can qualify by physical residence in a place and by providing their address details.

If the learner can provide these details, then we can consider them to constitute habitual, voluntary residence for settled purposes. As they currently do for learners in existing residency categories.

We may allow short term or temporary absences, or exceptional circumstances resulting in an individual being unable to provide an address where there are reasonable grounds and will be considered on a case-by-case basis.

Example

Tina is a non-UK national living in England on a permanent basis while seeking refugee status. Although she does not have a legal residency status, her learning provider allows her to start a course in academic year 2023/24.

As Tina does not meet the eligible residency requirements at the start of her course, she does not initially qualify for support from SLC.

In October 2023, after the start of her course, Tina is awarded refugee status. Although Tina was not lawfully resident in the UK/England on the first day of her course, Tina can now qualify for support. She qualifies as the award of her refugee status classifies as an “event”., She is considered to be settled in England as part of the regular order of her life and is living in England on a voluntary basis.

Cap residency address history checks at a maximum of 3 years for certain categories

Before 2023/24 people within the protection-based categories, DVLR and Bereaved Partners must show that they have been ordinarily resident in the UK and Islands since being granted that leave.

We will make residence history checks for the period since their last leave was granted. This can be difficult, particularly when someone has been granted indefinite leave to remain and has held that leave for a significant period before applying for student finance.

In addition, there are currently differences in treatment of applicants depending on the support applied for (UG/PG/FE) and whether they apply online or on paper.

From 2023/24, we will place a maximum cap of 3 year residence history assessment for the following categories:

- Calais leave

- Section 67

- Stateless persons

- Humanitarian protection

- Refugees

- Leave under the Ukraine schemes

DfE will not amend regulations, but will adapt their advice to support and improve the operational and customer journey for learners who are impacted.

If a learner has indicated they have not been outside the UK since they were awarded this status, then we will not make further checks.

Learners will be considered under the settled in the UK category, with the 3-year cap on residence history, if

- they are in any of the listed categories (except refugees)

- they have indefinite leave to remain

- they have 3 years ordinarily resident in the UK and Islands

Refugees must continue to be assessed as refugees even after they have acquired indefinite leave to remain. We can consider them under the ‘settled in the UK’ category when they have acquired British citizenship.

The following residency categories are usually granted indefinite leave to enter or remain (ILE/R) after three years, and so there will be a natural three-year cap.

- ARAP

- ACRS

- DVILR

- Bereaved partners

Once a learner has held ILE/ILR for three years (or a combination of ILE/R and any previous LLR where this was continuous and lawful residence), we will also consider hthem under the ‘settled in the UK’ category.

Reinstate the standard residency requirements that apply to learners applying via an ‘event’

We applied a change for academic year 2022/23, which disapplied certain residency requirements for any learner who qualified for support via an event.

This change was specific for academic year 2022/23, we will now reinstate the for academic year 2023/24, for learners who qualify for support via an event.

Where a new or continuing learner applies for Advanced Learner Loan funding in academic year 2023/24 as an event, they will again be subject to the standard residence requirements.

So we will revert to the previous residence requirements that we applied to learners qualifying via an event before we applied the temporary change for academic year 2022/23.

This includes the following requirements (where applicable to a specific residency category that can qualify for support via an event):

- to be ordinarily resident in England on the first day of the first academic year of the course/first day of the course (where applicable)

- to be undertaking or attending the course in England

- to not have come to the UK for the purposes of study

- to be ordinarily resident in the UK and Islands since the most recent leave was granted

2023/24 HE Student Finance for Higher Technical Qualifications

In academic year 2022/23, DfE introduced the HTQ (higher technical qualification) as a new qualification.

From academic year 2023/24, we will extend designation for higher education undergraduate support to include qualifying Level 4 and 5 FE courses and qualification types (for example Level 4 and 5 Certificates and Diplomas). Providers must apply for and receive HTQ approval from the Institute for Apprentices and Technical Education (IFATE) and satisfy the necessary designation criteria.

Before, these courses and qualification types would have qualified for ALL support, they will now qualify for higher education undergraduate support.

Example

Provider A offers an existing Level 4 Diploma in Digital Programming which traditionally qualifies for ALL support. Provider A receives HTQ approval from IFATE for this course for academic year 2023/24 and the course is considered to satisfy the necessary designation criteria to attract higher education undergraduate support. As a result, this course will attract higher education undergraduate support rather than ALL support for new students who start in academic year 2023/24 or later.

However, if a further education course receives HTQ approval but fails to satisfy the necessary designation requirements to attract higher education undergraduate support (for example, the provider is not OfS registered or the course is less than one academic year in duration), it will still be classified as an HTQ but will remain on the support package available before HTQ approval (in most instances, ALL).

Example

Provider B offers an existing Level 4 Diploma in Computer Programming which qualifies for ALL support. Provider B receives HTQ approval from IFATE for this course for academic year 2023/24. However, despite being approved as an HTQ, the course fails to meet the standard designation requirements to qualify for higher education undergraduate support. as the reason is provider B is not an OfS registered provider. Despite receiving HTQ approval, the course will not qualify for higher education undergraduate support and will instead continue to attract ALL support. The course is still recognised as an approved HTQ course, which also leads to the award of a Level 4 Diploma.

FE qualifications that traditionally qualify for ALL support that subsequently receive HTQ approval and satisfy the necessary designation criteria to qualify for HE UG support will cease to be designated for ALL support for any new learners starting the course from the point they are considered as designated HTQs.

However, any continuing learners who started their FE course before HTQ approval will remain on the original ALL support package available at the time their course started.

Example

Sarah is studying towards a Healthcare Science Associate Level 4 Diploma in academic year 2022/23 and receives ALL support. Sarah’s learning provider receives HTQ approval from IFATE for their Healthcare Science Associate Level 4 Diploma course for academic year 2023/24. As a result, new learners starting year one of this course from academic year 2023/24 will qualify for higher education undergraduate support.

However, as Sarah is a continuing learner and her course started before academic year 2023/24, before the point at which the course became a designated HTQ, Sarah will not be eligible for the higher education undergraduate support and will instead continue to qualify for ALL.

In comparison, Kevin is studying the Healthcare Science Associate Level 4 Diploma at the same learning provider as Sarah and begins year one in academic year 2023/24. The course is recognised as a designated HTQ course from academic year 2023/24 onwards, so Kevin qualifies for higher education undergraduate support rather than ALL.

Direct entrants will need to join a cohort that started in an academic year after the course was approved as a designated HTQ to qualify for HE UG support.

If a direct entrant joins a cohort that started in an academic year before HTQ approval they will qualify for the support package available at the time the course started.

Example

Course Y is an FE course attracting ALL support that receives HTQ approval for academic year 2023/24. Course Y meets the designation criteria and will qualify for higher education undergraduate support due to its status as an designated HTQ from academic year 2023/24. Learner X enters Course Y as a direct entrant to year 2 of the course in academic year 2023/24.

Learner X has joined a cohort of learners who started their course in academic year 2022/23 , before HTQ approval. Learner X joined a cohort who started the course before HTQ approval, so they are not eligible for higher education undergraduate support and would instead qualify for ALL, where eligible.

HTQs will not be designated for higher education undergraduate support by the devolved administrations, unless the underlying qualification is already designated for higher education undergraduate support such as, HNDs or HNCs that receive HTQ approval.

In academic year 2023/24, learners studying a designated HTQ, that would not previously have been designated for higher education undergraduate support for example, Level 4 Diploma, will only qualify for higher education undergraduate support if they are ordinarily resident in England.

If an HTQ course is designated for higher education undergraduate support for England domiciled students, it cannot also be designated for ALL support by the same learning provider.

ALL support will not be available as an alternative support option for devolved administration domiciled learners studying designated HTQs that before HTQ approval would have attracted ALL.

Example

A learner domiciled in England, studying in England on a designated HTQ, that would not previously have been designated for HE UG support, will qualify for higher education undergraduate support under the SSR from academic year 2023/24. Learners domiciled within the respective devolved administration, studying in England on a designated HTQ, that would not previously have been designated for higher education undergraduate support, will not qualify for higher education undergraduate support. The HTQ course will remain non-designated under the respective devolved administration’s student support regulations.

ALL will not be available as an alternative support option for these learners.

2023/24 Reverting ALL maximum suspension period to 12 months

Before academic year 2021/22, if a learner was suspended for a continuous 12-month period, then their application was automatically withdrawn.

We were asked to introduce an 18-month suspension period rule from March 2021 for a limited period of time due to the impact of COVID-19.

We decided to extend the 18-month suspension period for the duration of academic year 2022/23.

From the start of academic year 2023/24, from 1 August 2023, we will revert the maximum suspension period to 12 months.

This will apply for new Advanced Learner Loan funded learners whose suspension starts after the beginning of academic year 2023/24. Any learner suspended for 12 months or more from the start of academic year 2023/24 onwards should be automatically withdrawn.

Learners who suspended their studies before 1 August 2023 should continue to have the 18-month suspension period applied, in line with the suspension policy that was in effect when they suspended from their course.

Example

Gemma starts a designated FE learning aim on 1 October 2022. On 19 October 2023, Gemma decides to suspend her studies. As Gemma has suspended her studies before 1 August 2023, the point at which the maximum ALL suspension period reverts to 12 months, she is entitled to suspend her studies for a maximum period of 18 months before being withdrawn.

This allows for transitional protection for learners who may have suspended for more than 12 months following advice from their provider that their maximum suspension period is 18 months and intended to return within this timeframe.

All learners whose suspension starts after 1 August 2023 will be subject to the revised 12 month maximum suspension period.

Example

Carole starts a designated FE learning aim on 9 April 2023. On 19 August 2023, Carole decides to suspend her studies. Despite Carole starting her course before 1 August 2023, the point at which the maximum ALL suspension period reverts to 12-months, she will still be subject to the revised 12-month maximum suspension period. Her suspension starts after the beginning of academic year 2023/24.

2024/25 residency policy changes

Dependent children Indefinite leave to remain and abuse or bereaved partner

From academic year 2024/25

- children or step-children of those who’ve been given indefinite leave to enter or remain as a victim of domestic violence

- children or step-children of those who’ve been given indefinite leave to remain as a bereaved partner

may be eligible for funding under these categories without the need for the learner to have been granted leave too.

Adding Settlement as an event

Currently, to access financial support, learners need to hold settled status on the first day of their course. If they gain settled status after this date, the learner does not become eligible and cannot access support for the entire course.

From academic year 2024/25, we’ve added settled immigration status under any route to the regulations as an in-year qualifying event. This means learners will be eligible for support, if they meet the other requirements of the relevant residence category.

Ukraine Permission Extension Scheme

From academic year 2024/25 the Home Office has created a new Ukraine scheme called the “Ukraine Permission Extension Scheme”. The first award of leave under the new scheme is expected to be granted in March 2025.

The Ukraine Permission Extension Scheme will only be available to learners who have leave under one of the three current Ukraine schemes. These learners will be able to replace their existing leave when it expires with leave under the Ukraine Permission Extension Scheme. They’ll need to apply to the Home Office for leave under the Ukraine Permission Extension Scheme. Leave under the new scheme will not be automatically awarded on expiry of the current leave.

Ukraine Permission Extension Scheme leave will be limited leave, which in all cases lasts for 18 months. It’s not been confirmed what, if any, form of leave will be granted at the end of the 18-month leave period. However, it’s expected that these learners will be permitted to remain in the UK beyond the end of this 18-month period of leave. This is either through an extension to the Ukraine Permission Extension Scheme or through other standard immigration routes, allowing them to complete their course.

The Home Office is planning to close two of the current schemes to new learners:

- the Ukraine Extension Scheme predicted for Spring 2024

- the Ukraine Family Scheme predicted for the end of 2024

Any leave that has been granted before the schemes have closed will remain in place for the full three-year period. The Homes for Ukraine Scheme will remain open to new learners.

New learners in academic year 2024/25 or later, and their eligible family members, can apply for support under the Ukraine schemes category. The Ukraine Permission Extension Scheme leave must have been granted on or before the first day of the course.

Continuing learners from academic year 2024/25 with Ukraine Permission Extension Scheme leave, and their eligible family members, can apply for support under the Ukraine schemes category.

They must've been given funding under one of the current forms of Ukraine scheme leave and then granted leave under the Ukraine Permission Extension Scheme.

These learners will not be subject to regulatory termination provisions, where these apply, as long as they have a valid form of leave before the first day of the next year of their course.

New and continuing learners who are granted Ukraine Permission Extension Scheme leave may also become eligible as an event in academic year 2024/25.

Chagossians with British Citizenship

From AY 2024/25, we’ve introduced a new eligibility route within the British Overseas Territories (BOTs) category for Chagossians with British citizenship.

Chagossian learners will be eligible for funding if they’re:

- new Learners who start an eligible course in academic year 2024/25 or later (on or after 1 August 2024)

- continuing learners in academic year 2024/25 or later who started an eligible course in 2022/23 or 2023/24

Funding will be available to learners who:

- are Chagossians with British citizenship

- are undertaking an eligible course in England

- have been ordinarily resident in the territory comprising the UK, Islands, and specified BOTs for the full three-year period the first day of the course, with at least part of that time spent in the specified BOTs

Chagossians will be treated as being ordinarily resident in the British Indian Ocean Territory (BIOT) during any period they are not ordinarily resident in the UK and Islands, regardless of where they’re resident during that time.

The term ‘Chagossian’ includes the following:

- British citizens who were born on the islands which now form the BIOT

- British citizens who are a direct descendant of a person who was born on the islands which now form the BIOT (for example, their children, grandchildren and other direct descendants by birth or adoption)

Only those defined as ‘Chagossians’ are in scope for this eligibility category.

The following are excluded from the term ‘Chagossian’:

- stepchildren and other descendants who are related by marriage

any other family members who are not direct descendants of a person who was born in the BIOT

National Insurance number (NINO) process addition

Full-support categories

We have not made changes to the process for learners who apply under a ‘full support’ regulatory category. They’ll still need to provide a NINO before they’re paid.

Fee-only categories

From academic year 2024/25, the process will change for new learners who start a course on or after 1 August 2024, who are eligible under a ‘fee-only’ regulatory category. These learners will be able to access the first three monthly loan instalments. We’ll release the fourth and any following loan instalments when they give us their valid NINO.

2025/26 residency policy changes

Bereaved partners of Gurkhas and Hong Kong veterans and their children

From academic year 2025/26, bereaved partners of Gurkha and Hong Kong veterans and their children will qualify for the full package of student support available. This is subject to meeting other eligibility criteria and income assessment where needed.

Bereaved partners of Gurkha and Hong Kong veterans and their children will not be subject to the standard three-year ordinary residence rule. Instead, those eligible under this category will need to be ordinarily resident in England on the course start date. They will also need to have remained ordinarily resident in the UK and islands since their most recent grant of leave from the Home Office.

Becoming eligible as an event

Students granted indefinite leave to remain (ILR) or indefinite leave to enter (ILE) as the bereaved partner of a Gurkha or Hong Kong military veteran after the course start date will qualify for support. As will those who become the child of such a person after the course start date. This is as long as they apply within the relevant regulatory deadlines for applying for support when eligible as an event. ALL will be available for the entire course, provided the event occurs before the end of the course.

Eligibility and assessment

Ineligible learners factsheet

Learners must meet essential criteria to be eligible for Advanced Learner Loans. Some learners may not meet all the criteria and so their application is ineligible.

Having an ineligible application means that we cannot pay fees to you.

Ineligibility reasons

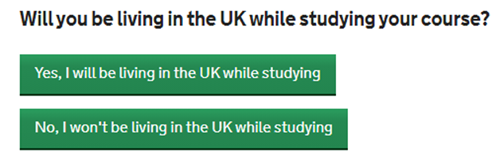

Applicant resides outside the UK

The learner is not living in the UK on the first day of their learning aim and throughout their studies.

Applicant does not meet the minimum age requirements

The learner is not 19 or over on the start date of their learning aim.

Applicant does not meet any of the valid residency criteria

The learner does not have the right residency to get a loan.

Learning provider is not funded

The learning provider details on the application form do not match any of the approved provider details we have received from the Department for Education (DfE).

Learning provider is not funded at course start date

The learning provider was not approved for funding on the proposed course start date.

Learning provider is currently suspended

The learning provider is not approved for funding because DfE has suspended it.

Applicant has applied for an unapproved course

The learning aim details on the application form do not match any of the learning aim details we've received from ESFA.

Course start date is before the launch of the Advanced Learner Loan scheme

The learner’s course starts before 1 August 2013.

Course start date is too late for funding

The course starts after the end of the current academic year, 31 July. It is too early to apply for a course that starts after this date.

Learning duration is less than the time allowed

The learner has applied for a learning aim that's shorter than the minimum duration of 2 weeks.

Application received too late

The learner has applied for a loan after the deadline date. The deadline date is the last day of the learning aim.

Applicant’s learning start date is after the learning end date

The learner has stated that the start date is after the learning end date in their application form.

Arrears or credit agreement

The learner has had a previous loan from us and is currently behind with repayments.

Applicant has had 4 A level loans already and none of them are withdrawn

The learner has already had the maximum number of loans allowed for a programme of A levels.

Applicant has reached the maximum number of loans they can have

The learner has had the maximum number of loans available.

Applicant or family member they live with is not serving in the UK armed forces

The learner is not eligible to receive an Advanced Learner Loan as they or a family member are not serving in the UK armed forces.

Start date of the course is before UK armed forces personnel became eligible

The learner’s course started before 1 August 2017.

Next steps to take

In some cases, the ineligibility reason is unlikely to change. In others, if information changes so could the application status.

Please see below for the next steps to take depending on the learner’s ineligibility reason. This will tell you who or what can trigger reassessment if it is applicable.

Applicant resides outside the UK

Not likely to change to eligible unless the learner’s circumstances change.

The learner cannot be eligible if they're residing outside the UK.

If the learner’s situation changes and they move to the UK, they could reapply for the course if:

- they meet all other residency criteria

- they update the course start date to after the date of permanent residence in the UK

From 1 August 2018, a learner not resident in England may still be eligible for an Advanced Learner Loan if they are:

- a serving member of the UK armed forces

- the spouse, civil partner or family member living with a serving member of the armed forces

- a dependent parent living with a serving member of the armed forces

From 1 August 2018 a new eligible residence category of stateless persons also exists. This applies to individuals who have been granted leave to remain as a stateless person by the UK Home Office. This leave would be granted because:

- they are stateless

- they have no right to residence in their country of former habitual residence or any other country

Applicant does not meet the minimum age requirements

Not likely to change to eligible unless the learner’s circumstances change.

The learner cannot be eligible if they're under 19.

When the learner turns 19 they could reapply for support if:

- they meet all other eligibility criteria

- they update the course start date so it is after they turn 19

Applicant does not meet any of the valid residency criteria

Not likely to change to eligible unless the learner’s circumstances change.

The learner cannot be eligible if they do not meet any of the standard residency criteria.

If the learner’s situation changes so they meet valid residency criteria they could reapply for the course if:

- they meet all other eligibility criteria

- they update the course start date to after the date of the valid residency status

Learning provider is not funded

Not likely to change to eligible unless the learning provider’s circumstances change.

The learner cannot be eligible if:

- they're not studying with an approved college or training organisation

- the college or training organisation does not have a current loans facility for that year

If the provider becomes approved or receives a valid facility, we can reassess the learner. They may become eligible if:

- they meet all other eligibility criteria

- they update their course start date to after the date the college or training organisation became approved

You can check whether you have a current loans facility on the Learning Provider Portal.

- Go to the Financials Home section of the portal.

- Select Loan Facility Details.

Learning provider is not funded at course start date

Not likely to change to eligible unless the learning provider’s circumstances change.

The learner cannot be eligible if:

- they're not studying with an approved college or training organisation

- the college or training organisation does not have a current loans facility

If the provider becomes approved or receives a valid facility, we can reassess the learner. They may become eligible if:

- they meet all other eligibility criteria

- they update their course start date to after the date the college or training organisation became approved

You can check whether you have a current loans facility on the Learning Provider Portal.

- Go to the Financials Home section of the portal.

- Select Loan Facility Details.

A learner may be ineligible for this reason if they have entered the wrong start date. In this case, you can submit a Change of Circumstance (CoC) on the Learning Provider Portal. See the Learning Provider Portal user guide for how to submit CoCs.

Learning provider is currently suspended

You should contact us or the Department for Education (DfE).

This means that you're not approved for funding because DfE has suspended you. Any learners who apply when you're suspended will be ineligible.

DFE usually suspends providers that decide they do not want to offer loans. If you've done this and your circumstances change, you must contact DfE to ask about a loan allocation.

Applicant has applied for an unapproved course

Not likely to change to eligible unless the learner’s circumstances change.

Learners cannot receive a loan if their learning aim is not eligible.

You should contact DfE with any questions about learning aim eligibility.

Course start date is too late for funding

The learner should call our ALL learner helpline.

Learners cannot use the current application to apply for a loan for any course that starts after 31 August that year. They must wait for the next academic year cycle to open before applying.

Learning duration is less than the time allowed

Not likely to change to eligible unless the learner’s circumstances change.

Learners cannot receive a loan if their course is shorter than 2 weeks.

If their circumstances change and the course lengthens, they must contact us to submit a CoC.

You cannot submit a CoC on the Learning Provider Portal because the application status will be ineligible.

Application received too late

Not likely to change to eligible unless the learner’s circumstances change.

Learners cannot apply for a loan retrospectively if the last date of their learning aim has passed.

If they have any queries about late applications they should call our ALL learner helpline.

The learning start date is after the learning end date

The learner should call our ALL learner helpline.

If the learner says on the application that the start date of their learning aim is after the end date, their application will be ineligible.

To correct this, they need to contact us with accurate dates.

Arrears or credit agreement

The learner should call our ALL learner helpline.

Although we do not look at a learner’s past credit history, we do consider any past debt with us. If they have bad debt or arrears with another student loan product, they may be ineligible.

They must contact us for advice on next steps.

Applicant has had 4 A level loans already and none of them are withdrawn

Not likely to change to eligible unless the learner’s circumstances change.

Learners will be ineligible if they've already had the maximum number of loans allowed for a programme of A levels.

They can apply for another type of learning aim. To change their learning aim, they'll need to call our ALL learner helpline.

You cannot submit a CoC on the Learning Provider Portal because the application status will be ineligible.

Applicant has reached the maximum number of loans they can have

Not likely to change to eligible unless the learner’s circumstances change.

Learners will be ineligible if they've already had the maximum number of loans allowed.

They may be able to apply for another loan if they previously withdrew from a past loan due to compelling personal reasons. They need to call our ALL learner helpline to explain this.

Learning aim levels and types factsheet

The Advanced Learner Loan (ALL) is available to support learners studying at the Department for Education (DfE) approved learning providers in England. They must be studying one of the following types and levels of DfE-designated learning aims:

- a programme of A levels (AS or A levels)

- an Access to HE Diploma

- general and technical qualifications at levels 3, 4, 5 and 6

Course duration

Learners are eligible for a loan for the duration of their course. However, there is a maximum time before they enter repayment.

This maximum time of learning will depend on their course:

- a programme of A levels (AS or A levels) – 2 years for each AS or A level

- an Access to HE Diploma – 2 years

- general and technical qualification at levels 3, 4, 5 and 6 – 3 years

A learning aim must be at least 2 weeks long. This ensures that all learners meet the initial 2-week liability period.

Distance learning

Learners can apply for loans for distance learning courses.

These are defined as courses delivered outside classrooms, of the provider’s hub and bespoke locations.

They must be based in England except in exceptional circumstances agreed with DfE, for example serving members of the armed forces.

Intensity

There is no distinction between full-time and part-time learning in further education. Advanced Learner Loans are available to eligible learners regardless of their intensity of study. However, they'll only be paid over a period of up to 3 years.

Previous and concurrent study

Learners can have up to 4 loans for the same type of vocational qualification. They can study the 4 learning aims in any order or at the same time. They do not need to progress through the learning aim levels. For example, a learner may want to study a certificate in a trade after completing a diploma in management.

Learners will only be entitled to one Advanced Learner Loan for:

- a programme of A levels (up to 8 separate loans if studying 4 AS levels followed by the corresponding 4 A levels)

- an Access to HE Diploma

This is because these learning aims are focussed on a progression-related outcome. This applies whether the qualification is achieved or not. The only exception is if a learner has had to withdraw from their studies due to compelling personal reasons.

Learners will be entitled to an Advanced Learner Loan while they're receiving a higher education loan. This includes postgraduate master’s, doctoral and maintenance loans. Similarly, a higher education applicant will be entitled to a higher education loan while they are in receipt of an Advanced Learner Loan.

Change of learning aim

You or the learner must tell us when they change to a different learning aim at your college or training centre, as this may affect their eligibility.

If you have not confirmed the learner’s initial attendance, they are pre-liability. This means they can change to any other type or level of learning aim.

Once you’ve confirmed their initial attendance, they’re post-liability. This means they can only transfer to a learning aim of the same level and type, unless they transfer to one of the following types of learning aim:

- Qualifications and Credit Framework (QCF) Certificate

- QCF Diploma

- vocational qualification

The LP Portal will allow a transfer from a QCF Certificate or a QCF Diploma to a vocational qualification, and a QCF Certificate to a QCF Diploma. If the learner decides to change to another learning aim type or a different level, they must withdraw from their current learning aim and make a new application. This applies even if they've achieved units that are part of the rules of combination of the new learning aim.

Armed forces personnel factsheet

Since 1 August 2017, new students may be eligible for support if:

- they're serving members of the armed forces, or family members who have moved overseas to live with them

- they're studying a designated course that is delivered by a UK college or training centre

Since academic year 2018/19, armed forces personnel and eligible family members living with them do not need to be studying in England to receive an Advanced Learner Loan. They may be eligible for support if they live in another UK country.

Earlier policy stated that they needed to be serving 'overseas' while now it states 'outside of England'. This means other UK countries are also covered.

This change applies to new students starting a course from 1 August 2018 onward who are:

- UK armed forces personnel

- eligible family members living with armed forces personnel

- living in another part of the UK due to being in the armed forces

- studying a designated course by an English provider

The armed forces are defined as:

- the Naval Service (Royal Navy and Royal Marines)

- the Army

- the Royal Air Force

Eligibility

Learners must meet some essential criteria to be eligible for the Advanced Learner Loan.

They must:

- be aged 19 or over on the first day of their course

- be living in the UK on the first day of their course

- have lived in the UK, the Channel Islands or the Isle of Man for 3 years immediately before their course

- be studying with a college or training organisation in England approved for public funding

- be studying an approved qualification

From 1 August 2017, learners who are not resident in the UK may still be eligible for an Advanced Learner Loan if they're:

- a serving member of the UK armed forces

- the spouse, civil partner or family member living with a serving member of the armed forces

- a dependent parent living with a serving member of the armed forces

The following family members will be eligible learners:

- the spouse or civil partner living with a member of the UK armed forces serving overseas

- a child, stepchild or adoptive child living with a member of the UK armed forces serving overseas

- a dependent parent living with

- a child who is a member of the UK armed forces serving overseas

- the child’s spouse or civil partner who is a member of the UK armed forces serving overseas

Evidence

If the student is a member of the armed forces, they must provide evidence of temporary employment outside of the UK as a member of the armed forces serving overseas.

If the student is a family member of the member of the armed forces, they must provide:

- evidence of their relationship to the member of the armed forces

- evidence that the member of the armed forces is temporarily employed outside of the UK as a member of the armed forces serving overseas

When applying as a dependent parent (or parent’s spouse or civil partner), we also need evidence to prove dependency. This must show that the parent is wholly or mainly financially dependent on the member of the armed forces. We will review this on a case by case basis.

Evidence frequency

We only need to see evidence of being a serving member of the armed forces overseas once, at the start of a new period of eligibility. This could be:

- at the start of a new course

- when a returning student moves overseas

- when a returning student (who is already overseas) applies after becoming eligible for the first time

Acceptable evidence

Acceptable evidence is a stamped letter, or stamped pro forma, from the Armed Forces Unit Records Office. If it has the unit stamp there will be no restriction on who can sign it for the learner.

The stamped letter or pro forma is enough to prove overseas employment in the armed forces and familial relationship to the member of the armed forces. It is also enough evidence of financial dependency of a parent.

Residency evidence to prove the learner's personal eligibility can either be originals or, at the discretion of the processing unit, unit stamped readable certified photocopies.

Leaving the armed forces

Once a learner studying overseas is eligible for student support, they'll remain eligible to the end of their period of eligibility (course end date or withdrawal date). This applies even if they or their family member leave the armed forces.

National Insurance number validation factsheet

When a learner applies for the Advanced Learner Loan, we ask them to give us their National Insurance number. They can find this on a pay slip, P60 or their National Insurance number card (although these cards are no longer issued). We'll use this number when the learner has completed the course and goes into repayment.

The National Insurance number does not form part of the eligibility criteria. We can assess and approve the application without it, and you can confirm the learner’s attendance. However, we will not be able to make a payment to you until we've received and validated the learner's National Insurance number.

National Insurance numbers go through validation by the Department of Work and Pensions (DWP). The numbers are checked against details DWP holds. They'll tell us if it is a valid number. If it is not valid, they will tell us why.

Over 99% of learners provide their National Insurance number on their application form. The applications will come up as NINO Unverified on the Learning Provider Portal until DWP has verified the numbers.

We've created a flowchart that shows the verification steps described in this chapter. You can download or print the National Insurance Number flowchart here.

The validation process

Once a learner has submitted an application form with the appropriate supporting evidence, we'll process it.

Once we've approved the application, we'll send the National Insurance number to DWP for validation.

We batch up National Insurance numbers and send them to DWP on Wednesdays. DWP returns them to us the following Wednesday. We update our systems with the DWP file details on Wednesday evenings.

If an application is approved on a Thursday, we will not send the National Insurance number to DWP until the following Wednesday.

We will make payments when:

- DWP has matched and verified the National Insurance number

- you've entered a Unique Learner Number (ULN)

- you've confirmed the learner’s attendance

Why do we wait until applications are approved before verifying the National Insurance number?

Learners need to sign a declaration to agree to the terms and conditions of the loan. They also need to give us consent to share their data with third parties. Once we have their signature to confirm this, we can move the application to Approved status and share data with the DWP.

Learners without National Insurance numbers

What happens to applications without a valid National Insurance number?

DWP will try to correct any mismatches and match learners to their National Insurance numbers even if they have not supplied it. DWP can currently match 98% of learners with their National Insurance numbers, whether they initially gave these or not.

If DWP cannot match the National Insurance numbers or make any corrections, they'll let us know when they return the batch. We'll contact the learner and tell them how to get the information.

There are several reasons why a National Insurance number can come back as unmatched. Depending on the reason, we may need further evidence from the learner:

- change of surname – a clear photocopy of the learner’s birth certificate, marriage certificate, passport or deed poll certificate showing their current name

- change of forename – a clear photocopy of the learner’s birth certificate, marriage certificate, passport or deed poll certificate showing their current name

- date of birth – a clear photocopy of the learner’s birth certificate or passport showing their date of birth

- incorrect National Insurance number – a clear photocopy of a P60 form, payslip or National Insurance number card or letter that shows the learner’s name and correct National Insurance number

On some occasions we may not know why the National Insurance number has come back as unmatched.

When the learner sends us the evidence we need, we'll send the National Insurance number to DWP again for verification.

What happens if the learner does not have a National Insurance number?

We can still process the application. Once it is approved, we'll send the learner’s details to DWP for validation. If the details are unmatched DWP will send a file to Job Centre Plus. The learner will receive a letter from Job Centre Plus, arranging an appointment at their local centre.

Frequently asked questions about National Insurance numbers

Do EU students have to give National Insurance numbers?

They do not, but we'll ask them to provide 2 alternative contacts on the application before we can make payment.

If the learner has a valid National Insurance number, we'll verify the details with DWP.

Can we give you a learner’s National Insurance number?

The National Insurance number is personal information. We cannot accept this from a third party and usually do not need to, as learners are extremely good at supplying it themselves.

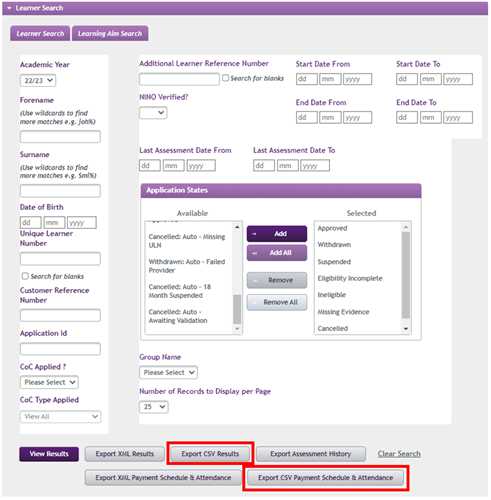

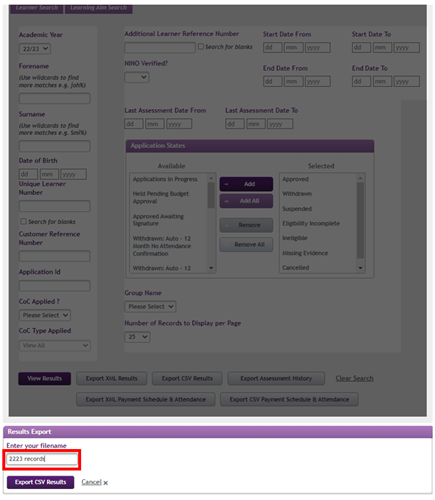

How can I view unverified National Insurance numbers on the Learning Provider Portal?

LP Administrators and LP Advisors can search for approved applications with unverified National Insurance numbers.

- Go to the Learner Search tab.

- Select a year from the Academic Year dropdown.

- Select No from the NINO Verified? dropdown.

- Select Approved on the Applications tab.

You can view the National Insurance number verification flow chart here.

How can we contact you?

If learners have any questions about the National Insurance number process, they should contact the ALL learner helpline.

If you need advice about this process, you should contact our Partners Support Desk.

A level factsheet

To be eligible for an Advanced Learner Loan, learners must be studying at an approved learning provider in England. They may study any of the following types and levels of approved learning aims:

- a programme of A levels (AS or A levels) – up to 4 full A levels

- QAA Access to HE Diplomas

- vocational qualifications at levels 3, 4, 5 and 6

Learners can have up to 4 loans. These can be any combination of the above types and levels.

For learners studying A levels, a programme can include up to 4 full A levels. This means that one programme may have up to 8 separate loan applications if the learner undertakes AS level study. They can make these applications at the same time or one after the other.

A programme of A levels together counts as only one of the 4 loans. A learner can still apply for 3 more loans for learning aims that are not AS or A levels.

Changes between AS and A level

Following the changes to the way A levels work, learners can only apply for an AS level learning aim or a full A level. One-year A2 learning aims have been removed.

An AS level learning aim usually takes one year. A full A level learning aim is longer with a higher maximum loan rate.

If a learner wants to continue from an AS to a full A level, they or you can submit a Learning Aim CoC to change to the new course. This is possible whether their application is in pre-liability or post-liability status.

Learners are in pre-liability status if you have not confirmed their initial attendance. This means they are free to change:

- to a learning aim of the same level and type

- to a learning aim of a different level or type

Once you have confirmed a learner’s initial attendance, their application will be in post-liability status. A post-liability learner cannot change to a different type of learning aim at the same level. Any fee charged for the A level application should take into consideration any fees already paid for the AS level.

Learners who are applying for a full A level attract a higher rate of loan because they may be studying for longer.

If a learner is only applying for a full A level to top up previous AS level study, you should reduce the fee on the new application to reflect their prior attainment.

The online system currently allows up to 4 applications. It does not recognise that a programme of A levels can be made up of 8 applications. Learners who would like to take out more than 4 loans to make up their A level programme need to submit separate paper applications after submitting their 4 online applications.

Subsidiary to Extended Diploma

Background

Subsidiary, 90 Credit and Extended Diplomas are learning aim types that are eligible for an Advanced Learner Loan.

This type of learning aim is slightly different to others as learners often “top up” from one to the other.

This factsheet explores situations in which learners move between these aims and how to properly attribute loans funding for each scenario.

Funding rules

The Department for Education publishes funding rules annually. You can find the most up to date Advanced Learner Loans Funding and Performance Management Rules on GOV.UK.

In relation to Subsidiary to Extended Diplomas, the funding rules state the following.

Where a learner undertakes a Subsidiary Diploma and progresses to an Extended Diploma at the same level, the progression can be considered as a single loan and the loan amount amended through the change of circumstance (change of learning aim) process (If there is no break the learner may stay on the original loan.)

- The change must be reported while the learner is still in learning on the Subsidiary Diploma. (This must be done before the end date of the original learning aim.)

- You must issue another learning and funding information letter

- The learner must make a new loan application to cover the fee for the Extended Diploma (The learner must complete a new Loan Request Form for an increased loan, not a new ALL application form.)

Where a learner has already undertaken a Subsidiary Diploma funded with a loan and then wishes to undertake an Extended Diploma at the same level and in the same subject at a later date (“At a later date” means that the learner did not originally have the intention of topping up to an extended diploma, the end date of the original aim has passed and there was a break between the original and new learning aim), they can apply for another loan for the Extended Diploma within their overall entitlement to four loans. In this scenario providers must reduce the fee charged to the learner for the Extended Diploma to take account of the prior study of the Subsidiary Diploma.

Scenarios

As a Learning Provider you will have to work with the learner to decide if they remain on the same loan application or they apply for another, when transferring between subsidiary and extended diplomas. The way in which you do this is to decide whether the learner has had a break.

Scenario 1 – Learner A

Learner A has a 2020/21 application for a level 3 Subsidiary Diploma (this is their first Advanced Learner Loan)

Learner A would like to study a level 3 Extended Diploma from September 2021. They informed their provider before the end date of their original learning aim.

The provider must submit a change of circumstance notification to

- change the learning aim from the Subsidiary to the Extended Diploma before the end date

- adjust the original end date to the revised end date for the Extended Diploma

- increase the fee amount to reflect the new fee for the Extended Diploma

The learner must

- submit a loan request form increasing their loan in line with the new fee, if necessary

Due to the circumstances above this learner is

- continuing with the same loan application and therefore using one of their 4 loans

Scenario 2 – Learner B

Learner B has a 2019/20 application for a level 3 Subsidiary Diploma (this is their first Advanced Learner Loan)

After completing the original course, Learner B has returned 12 months later and would like to study a level 3 Extended Diploma from September 2021. They did not inform their provider before the end date of their original learning aim.

The provider must

- inform the learner to receive a loan they must apply for a second Advanced Learner Loan

- reduce the fee charged to consider the completion of the Subsidiary Diploma

The learner must

- submit a new ALL application to the Student Loans Company

Due to the circumstances above this learner is

- not classed as continuing and therefore, due to applying for a second loan, is using 2 of their 4 loans

QAA Access to HE write-off factsheet

Eligibility

To be eligible for a QAA Access to HE Diploma loan write-off, a learner must meet the following criteria.

- The learner must have taken out an Advanced Learner Loan (ALL) for a QAA Access to HE Diploma course that they have completed.

A learner will be close to completing their learning aim when you make the final attendance confirmation. Also, the QAA Access to HE account Diploma application must not have withdrawn or suspended status on the course end date.

The learner does not have to achieve a specific outcome such as passing exams. However, to progress to higher education, they would normally need to meet the requirements of the awarding body.

If the learner completed one QAA Access to HE Diploma course, they will be entitled to write off of any incomplete QAA Access to HE Diploma loans. For example, this includes courses where they withdrew due to compelling personal reasons.

- The learner must not have any outstanding loan accounts with arrears or charges. If they do, they can become eligible for write-off once they clear the arrears.

- The learner must be eligible to apply for tuition fee support towards a Student Finance England (SFE) funded course of higher education. This must be true on the first day of the first academic year of their higher education course.

- The learner must have completed a higher education qualification that was eligible for SFE funding.

All higher education qualifications designated for SFE funding count. This includes:

- Higher National Certificates

- Higher National Diplomas

- foundation degrees

- NHS funded courses

The learner does not have to achieve a specific outcome, such as passing exams or gaining a specific class of degree.

There does not need to be a relationship between the QAA Access to HE Diploma course and the higher education qualification.

Learners will still be eligible for a write-off if they self-funded their higher education qualification, as long as they:

- were eligible for SFE funding

- completed a higher education course that was eligible for SFE funding

This includes students who were not eligible for SFE tuition fee support due to previous higher education study or because they already had an equivalent level qualification (ELQ).

A learner's entitlement to a write-off will not be affected if they suspend, repeat or transfer their higher education qualification. Only a withdrawal will affect entitlement.

In AY 2018/19, the Department of Health and Social Care stopped funding new students on postgraduate healthcare courses in England. Since then, the Department for Education (DfE) has provided support through us to eligible English domiciled students starting designated postgraduate healthcare courses.

Therefore, students with an ALL who complete a designated postgraduate healthcare course will now be eligible to have their ALL written off.

Completion of the QAA Access to HE Diploma

When a learner completes their QAA Access to HE Diploma learning aim, they will follow the usual repayment process. This means entering repayment in the April after the end of their course.

They do not have to progress immediately from the access course to the higher education course. The offer to write off the loan for the QAA Access to HE Diploma will remain open until they complete a higher education course. It is possible that they will enter employment in this period. If they are on Plan 2 and earn over £28,470, they will start to make repayments

Access to HE write-off on completion of the higher education qualification

When the learner completes the higher education course, they can have the balance of their loan for the Access to HE Diploma written off. This includes any loans for Access to HE Diploma courses where they withdrew.

Tuition Fee Loan funded higher education students

When a higher education student who received tuition fee support completes their higher education qualification, we will check if they previously completed a QAA Access to HE Diploma. They do not need to send us evidence of having completed their higher education qualification. We will count them as having completed it when:

- the university or college has made the final attendance confirmation in the final year

- their higher education course does not have withdrawn or suspended status on their course end date

We will automatically write off the balance of the QAA Access to HE Diploma loan for these students. We will write to them to confirm this.

Part-time, placement, overseas and non-Tuition Fee Loan funded higher education students

Not all higher education students who are eligible for the QAA Access to HE Diploma write-off will have received a full-time Tuition Fee Loan. They may have received part-time or other SFE funding.

These students do not have their attendance confirmed in the same way as full-time Tuition Fee Loan students. We will count them as having completed their higher education course when they meet the following criteria:

- part-time students – when the university or college makes the last attendance confirmation in the final year

- placement or overseas students – when they have been paid their final year maintenance instalment

- students not funded by a Tuition Fee Loan – when the university or college has confirmed registration in the final year

For all students, the account must not have withdrawn or suspended status on the course end date.

We will include these students in the process that automatically writes off the balance of the QAA Access to HE Diploma. We will send them a letter once their loan balance has been written off.

After the write-off, we will check with the university or college to confirm that the student completed their higher education course. If we find that they did not complete, we will reverse the write-off and let the student know.

Self-funded higher education students

Students who self-fund their higher education qualification are still entitled to a write-off if they meet the eligibility criteria.

Self-funding students will not be on our higher education systems, so there will not be an automatic process. We will promote write-offs to these students through our information and guidance.

Students need to give us details of their higher education course. They will also need to give us evidence of their SFE funding eligibility. This will be based on the policy rules on the first day of the first academic year of their higher education course.

We will contact you to confirm that they completed their higher education course. We will then contact the student to let them know if they are eligible for the write-off.

Write-off amount

There will be no financial limit to the amount of loan we will write off. We will write off the full outstanding balance of QAA Access to HE Diploma loans at the course end date.

The write-off will cover any interest accrued on the loan amount. However, we will not refund any repayments that have been made before the end of the higher education course.

For self-funded learners, the loan is not automatically written off. Therefore they may have made repayments after the end of the higher education course. We will refund these payments.

Compelling personal reasons factsheet

Maximum loan entitlement

Learners are entitled to apply for up to 4 Advanced Learner Loans for a approved learning aims.

If a learner withdraws from a course funded by an Advanced Learner Loan after the initial liability point (14 days), this counts as one of their 4 loans.

A learner is only entitled to one Advanced Learner Loan for the following qualifications:

- a programme of A levels

- an Access to HE Diploma

This is because these qualifications focus on a particular outcome related to progression. So, we will not fund repeat study. The one exception is where a learner has had to withdraw from their studies due to compelling personal reasons (CPR).

Eligibility – compelling personal reasons

Sometimes there are extenuating circumstances when a learner withdraws from their learning aim. We can take these into consideration and regard them as CPR.

We can award learners repeat funding through the Advanced Learner Loan if they can give enough evidence of their CPR.

There are many different reasons why learners may not be able to complete their learning aim and withdraw. These can include:

- illness

- bereavement

- family crisis

- pregnancy

- unavoidable caring responsibility

The above list is not exhaustive. All CPR cases are unique and will be granted on their own merit depending on the learner’s circumstances.

When a learner is granted CPR, they will still be liable for the loan they took out before. CPR does not write off loan liability, it only allows for repeat funding.

There is no time limit in which a learner must submit evidence for CPR. There is also no limit to the number of times we can consider CPR.

Examples

Alice has had Advanced Learner Loan funding for 3 different learning aims. She then receives a fourth loan for a Level 3 Diploma in Hairdressing in academic year 2021/22. She drops out as she decides the course is not for her and she wants to pursue a different career. She has now used her maximum entitlement of 4 loans. There are no extenuating circumstances for why she withdrew from her course, so CPR cannot be applied. Alice is not entitled to receive a further Advanced Learner Loan.

Luke received 2 Advanced Learner Loans between academic years 2019/20 and 2020/21. These were for a Level 3 Certificate and an Access to HE Diploma. Luke competed his Level 3 Certificate but withdrew from the Access to HE Diploma due to CPR. During academic year 2021/22, Luke would like to apply to use repeat funding for a second Access to HE Diploma. Luke is eligible for funding as he withdrew from the first Access to HE Diploma due to CPR.

Georgia has already completed an Access to HE Diploma in Business. She then withdraws from an A level component due to CPR in academic year 2020/21. During academic year 2021/22 she applies for CPR to use the repeat funding for another Access to HE Diploma. Georgia is not eligible for the repeat funding of the Access to HE Diploma. This is because the CPR relates to her withdrawal from the A level component, not the earlier Access to HE Diploma.

Applying for compelling personal reasons

If a learner has withdrawn due to CPR and later wants to apply for a course funded by an Advanced Learner Loan, they can submit evidence to receive repeat funding.

We can accept photocopies of all evidence of their mitigating circumstances supporting a claim for CPR. This can include:

- medical evidence from a GP on headed paper

- letter from a learning provider on headed paper

- letter from social services on headed paper

- letter from clergy or a professional person on headed paper

- death certificate

- birth certificate

CPR evidence should be signed and dated, confirming why the learner withdrew from their course.

In some circumstances one piece of evidence may not be enough. We recommend that learners send in as much evidence as they can.

If CPR is awarded, the learner will need to submit a new application form for their new course.

If a learner thinks they may be eligible for CPR, they should discuss this with you first. They should then phone our ALL learner helpline to discuss the evidence we need from them.

EU exit and Advanced Learner Loans

The UK left the EU on 31 January 2020. The following transition period ended on 31 December 2020. From 1 January 2021, new immigration rules apply.

Academic year 2020/21 learners

Student support policy rules will be unchanged for all learners who started a course in academic year 2020/21 or earlier.

Support will continue on the same eligibility grounds until they have completed their period of study. This applies even if the period of study started after the end of the transition period in academic year 2020/21 (from 1 January 2021 to 31 July 2021 inclusive).

EU, EEA and Swiss national learners and their eligible family members will continue to be eligible for student support.

EU Settlement Scheme

EU, EEA and Swiss nationals and their respective family members who were lawfully resident in the UK on or before 31 December 2020 can apply to the EU Settlement Scheme (EUSS). Those granted settled or pre-settled status under EUSS will be eligible for support on broadly the same basis as now. This is subject to meeting the usual residency requirements.

They have until 30 June 2021 to apply to EUSS. Any discretion to extend this date will be applied on a case by case basis. In certain circumstances, family members can join an EEA or Swiss national in the UK after 31 December 2020 and apply to EUSS once they are here. Applications will, in this circumstance, be considered after 30 June 2021. Family members granted a status will have the same rights in the UK whether or not they arrived by the end of the transition period.

Applicants to EUSS may be awarded:

- settled status (meaning indefinite leave to remain)

- pre-settled status (limited leave to remain)

Which status a learner is awarded depends on how long they have been living in the UK when they apply.

They must have at least 5 years of continuous lawful residence in the UK to be awarded settled status.

They may be awarded pre-settled status if they have a shorter period of UK residence. This can be any period of lawful residence that's less than 5 continuous years. After 5 years of continuous lawful residence in the UK they can apply to change this to settled status. They must do so before the pre-settled status expires.

These eligibility changes do not apply to Irish citizens living in the UK, Islands or Ireland. Their right to study and to access benefits and services will be preserved on a reciprocal basis for British and Irish citizens under the Common Travel Area arrangement. Irish citizens who have not been resident in the UK, Islands and Ireland may need to be resident in the UK by the end of the transition period to be eligible for student support.

Evidence – settled status

Learners who have been granted settled status under EUSS will generally be eligible for tuition fee support if they have been ordinarily resident in the UK and Islands for at least 3 years immediately before the start of their course.

They will need to prove their status by providing their digital share code and proof of their identity. This could be an original valid passport or valid national identity card.

Evidence – pre-settled status

Learners must have lived in the UK, Gibraltar, EEA or Switzerland for 3 years immediately before the start of their course.

They will need to prove their status by providing their digital share code and proof of their identity. This could be an original valid passport or valid national identity card.

UK nationals living outside the UK

UK nationals and their family members living in the EEA or Switzerland on 31 December 2020 will generally be eligible for tuition fee support for courses starting on or after 1 August 2021 and before 1 January 2028. They must meet the following conditions:

- they are living in the EEA or Switzerland on 31 December 2020 (or have moved back to the UK immediately after living in the EEA or Switzerland)

- they have lived in the EEA, Switzerland, the UK or Gibraltar for the last 3 years before the start of the course

UK nationals and their family members living in the EU Overseas Territories on 31 December 2020 will continue to be eligible for home fee status in England for courses starting before 1 January 2028.

UK nationals living in the other British Overseas Territories and their family members will be eligible for home fee status when studying in England, on the basis of 3 years’ residence in the British Overseas Territories, UK and the Islands before the start of the course.

Family members of UK nationals living in the UK

Family members of UK Nationals resident in the UK will qualify for home fee status and tuition fee support from Student Finance England on the basis of 3 years’ ordinary residence in the UK and the Islands. They must also be undertaking a designated course in England.

Children of Swiss nationals

The children of Swiss nationals covered by the Swiss Citizens’ Rights Agreement will generally be eligible for home fee status, tuition fee and maintenance support after 3 years’ residence in the UK, Gibraltar, EEA and Switzerland.

Children of Turkish Workers

Children of Turkish workers are not covered by the Withdrawal Agreements. However, they will be eligible for home fee status and student support after 3 years’ residence in the UK, Gibraltar, EEA, Switzerland and Turkey if:

- they and their parent are living in the UK by 31 December 2020

- the parent’s period of leave to remain continues to be valid

Further information

You can find further guidance on GOV.UK.

Adult Skills Fund factsheet

The purpose of the adult skills fund (ASF) is to support adult learners in non-devolved areas to gain skills for meaningful, sustained, and relevant employment or progress to further learning that supports this goal.

Funding overview

ASF provides funding for level 1 to level 3 learning.

ASF includes 4 legal entitlements for full funding as set out in the Apprenticeships, Skills and Children Learning Act 2009. and enable eligible learners to be fully funded for the following qualifications:

- English and maths up to level 2 for those aged 19 and over who have not achieved a GCSE grade A* to C or grade 4 or higher, and/or have been assessed as having an existing skill level lower than grade 4 (even if they have previously achieved a GCSE or equivalent qualification in English or maths)

- first full qualification at level 2 for those aged 19 to 23

- first full qualification at level 3 for those aged 19 to 23

- Essential Digital Skills Qualifications (EDSQ) or Digital Functional Skills Qualifications (FSQ), up to level 1, for those aged 19 and over, with assessed digital skills below level 1

Learners earning below £25,750, or who are unemployed can also receive full funding for qualifications within policy entitlements, including:

- free courses for jobs

- level 2 local flexibility

- heavy goods vehicle (HGV) training

- 19 to 24 work placements

- Sector-based Work Academy Programme (SWAP)

- The King’s Trust (formerly Prince’s Trust)

- English for speakers of other languages (ESOL)

Learners who do not qualify for free funding can apply for an Advanced Learner Loan.

More information can be found in the Adult Skills Fund funding and performance management rules.

Free courses for Jobs (FCFJ)

FCFJ is funded through ASF. It offers targeted support for adults who are unemployed or earning below £25,750 annually to take specific level 2 and level 3 qualifications.

A list of all FCFJ qualifications is available on GOV.UK.

Eligible learners may receive full funding for their chosen qualification, removing the need for an Advanced Learner Loan.

Provider Responsibilities

For adults aged 19 and above undertaking FCFJ level 3 qualifications you must:

- check a learner’s eligibility for full funding under the Level 3 criteria before they apply. Record this in the learner’s file. The eligibility criteria is detailed in the ASF funding rules.

- if the learner has not used their FCFJ entitlement, inform them before they apply for funding.

- Do not offer a loan-funded place if the learner qualifies for level 3 funding through FCFJ.

If a loan-funded place was offered in error

Submit a fee-charged change of circumstance (CoC) through the Learning Provider Portal to reduce the learner’s fee liability to zero. Leave the application at approved status. We will recover any overpayment from future loans payments or invoice you if payments are insufficient

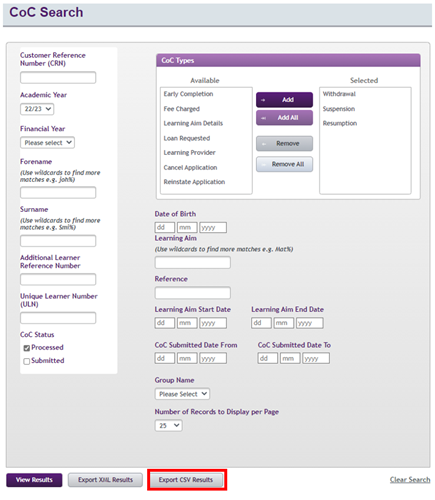

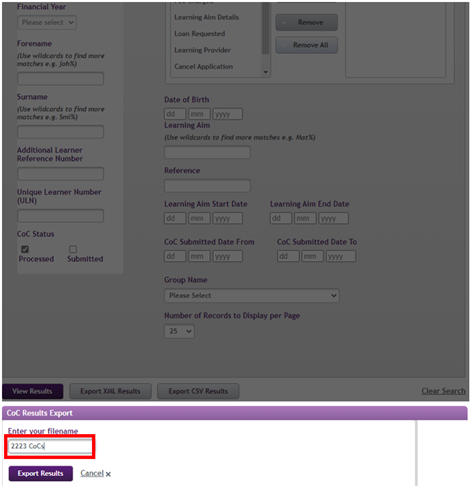

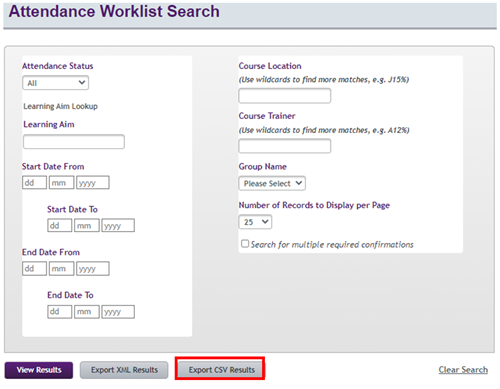

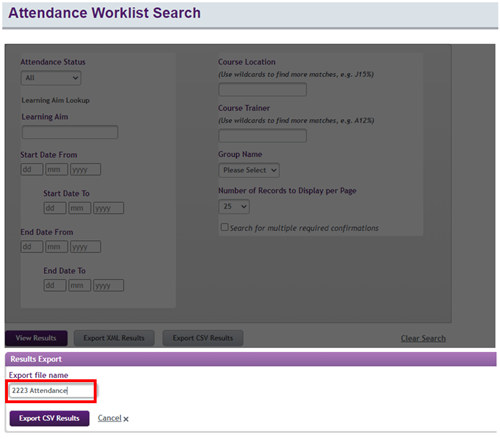

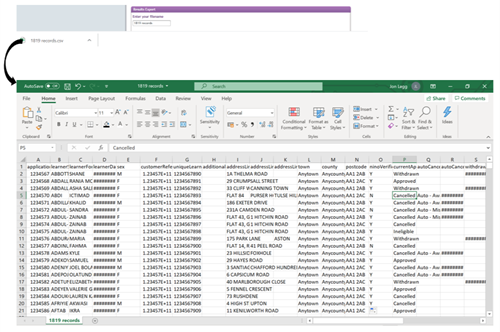

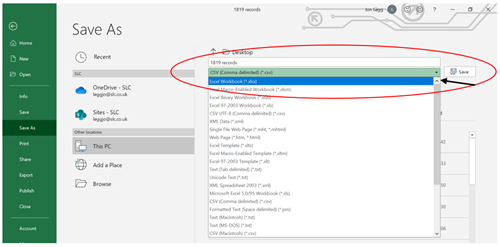

Advanced Learner Loans only providers